Technology, the inveterate disruptor, is at it again. Granted, it’s always kicking up dust. But every now and then it coughs up something major, sending a shiver down the industry’s spine. So it is with blockchain, a distributed database.

A technology does not become a disruptor unless it challenges incumbent ways of doing business. Blockchain does that, although much of it right now is happening in the exploratory or theoretical realms. But its extended possibilities make it the very stuff of techno-dreams, just like many other technologies that we now take for granted once was.

But we’re getting a little ahead of ourselves here.

Blockchain—The Decentralized Database

To understand why blockchain is hogging the limelight right now, we need to look behind the scenes at how transactions currently work. To keep it simple, let’s take the case of a bank transaction.

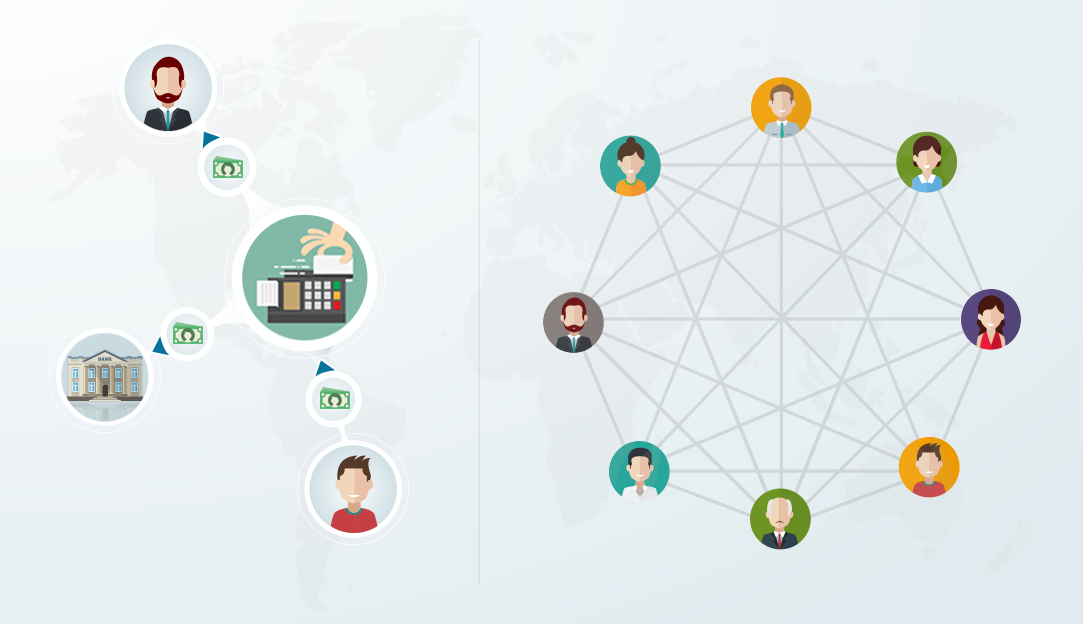

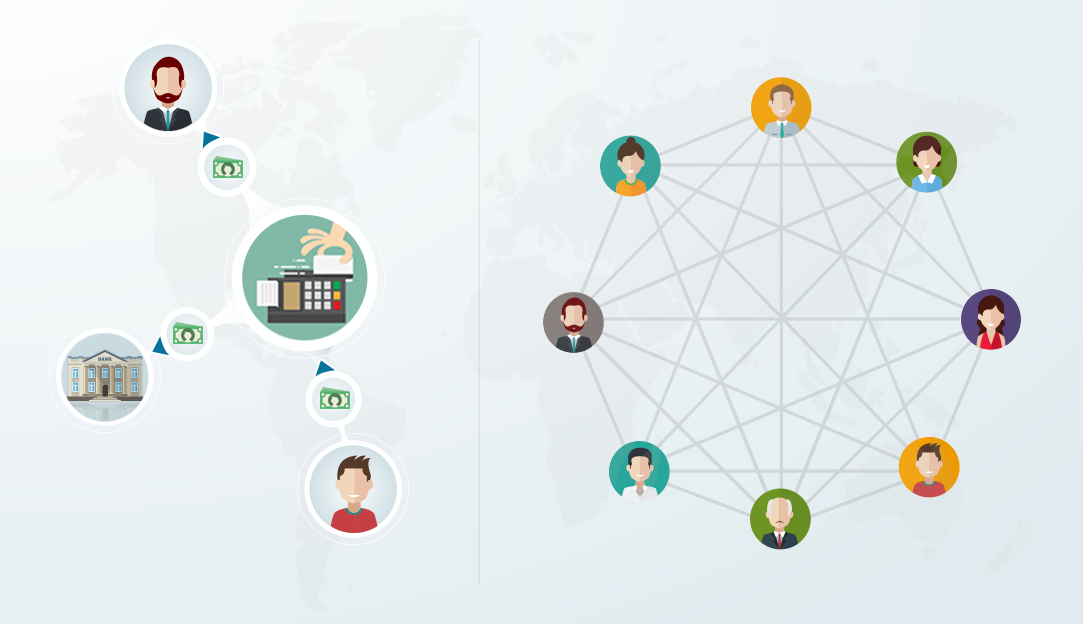

Imagine you owe your life insurance company monthly premiums. You pay them electronically via your bank. The bank settles the payment, first by verifying you have the said amount in your account and then by deducting it and adding it to the payee’s account. The insurance company trusts you to pay every month without fail, thanks to the bank which acts as a trustee on your behalf. And thanks to the trust you both place in the bank’s centralized ledger, there is never a dispute between the two of you regarding the payments.

Now imagine a situation where you and your insurer didn’t have to rely on a bank to authenticate your transactions. You both get to keep a shared ledger where every transaction you make is immutably recorded. Imagine this system of trust cannot be breached by anyone. That’s blockchain for you.

How Blockchain Transactions Work

If you’ve heard of the virtual currency bitcoin before and know a bit about how it works, then you’ve already rubbed shoulders with blockchain technology. Blockchain as a generic technology emerged from the effort to create bitcoin.

Blockchain is essentially a new kind of data platform. Unlike traditional systems, data here is distributed over a peer-to-peer network rather than stored on a central server (a bit like BitTorrent, where users have copies of complete or partial files shared over a network). Each node in the network records and timestamps transactions and stores them as a block. A block is much like your personal bank statement. As more transactions take place, new blocks are added. These blocks are linked sequentially with the preceding block by means of hash codes, thus forming a blockchain. The blockchain is like the general ledger of a bank. The difference here is that the copies of the ledger are available to all participants in a blockchain network. Because the blocks are encrypted with hash codes, no one within or outside the network can meddle with them.

[caption id="attachment_16564" align="alignnone" width="1083"]

Current transaction model vs. blockchain-based transaction model[/caption]

Trustless computing is what brings blockchain most accolades. Trustless means there is no need for a trusted authority, such as a bank, to keep the transactions rolling between people in a network. Even if the participants don’t know each other, much less trust each other, they can still transact value within the restrictions of rules written into the system. Trust works not in the conventional sense of faith in a third-party, but as governed by strict algorithms. In effect, it is just as trustworthy as the traditional system, minus the external intervention, and it’s a tad more transparent.

Implementing Smart Contracts

A blockchain-powered payment system enables the execution of smart contracts. Smart contracts are nothing but virtual contracts drawn up on the basis of pre-written business logic. Entities participating in a blockchain can create contracts and set protocols to automate their enforcement. Smart contracts can be handy for transacting cryptocurrencies or making regular payouts to organizations or even ensuring compliance. A blockchain-enabled, programmed contractual system ensures those contracts are fulfilled in a safe and transparent manner.

Implications for Financial Services

As the blockchain technology unseats transactional methods that are etched in stone, it’s unsettling effects will be felt across the financial services sector. It doesn’t mean that banks are going to be wiped off the face of the earth now that technology makes it possible for users to jointly administer and verify payments on their own. At the same time, there’s no place for status quo or complacency. Not one to be caught flat-footed, major banks across the globe have already entered into partnerships with technology companies to explore ways in which they can use blockchain to their advantage.

One obvious use case for banks would be to reduce the burden of audit. A bank routinely deals with thousands of transactions worth ginormous amounts of money every day. Keeping these payment networks running efficiently is an expensive proposition for banks. Governance and audit costs typically eat into bank profits. A self-audited system enabled by blockchain technology can help lower the cost of transactions and drive the efficiency of back office operations.

Beyond Banking

Banking is not the only sector to be rattled by the blockchain technology; the ripples have reached other service areas as far flung as retail, IoT, and healthcare. Maintaining a universal system of records is potentially useful in every sector where value is transacted. Apart from reducing infrastructure costs, it promises more secure, efficient, and transparent transactions.

There’s no doubt that a host of innovations will tumble out of this technology in the near future. And as the technology matures, its potential and pitfalls will become more apparent. While it’s still early in the day, some breakthroughs such as those in bitcoin (which several businesses have started accepting in return for goods and services) are already out there for us to see.

How do you know if there’s a use case for blockchain in your area of business? Check out the applications we've shortlisted for various domains.

Current transaction model vs. blockchain-based transaction model[/caption]

Trustless computing is what brings blockchain most accolades. Trustless means there is no need for a trusted authority, such as a bank, to keep the transactions rolling between people in a network. Even if the participants don’t know each other, much less trust each other, they can still transact value within the restrictions of rules written into the system. Trust works not in the conventional sense of faith in a third-party, but as governed by strict algorithms. In effect, it is just as trustworthy as the traditional system, minus the external intervention, and it’s a tad more transparent.

Current transaction model vs. blockchain-based transaction model[/caption]

Trustless computing is what brings blockchain most accolades. Trustless means there is no need for a trusted authority, such as a bank, to keep the transactions rolling between people in a network. Even if the participants don’t know each other, much less trust each other, they can still transact value within the restrictions of rules written into the system. Trust works not in the conventional sense of faith in a third-party, but as governed by strict algorithms. In effect, it is just as trustworthy as the traditional system, minus the external intervention, and it’s a tad more transparent.