Insurance carriers rely heavily on the agility of their distribution partners for success. For our client, a U.S.-based carrier, rapid growth in partnerships revealed a critical bottleneck: a largely manual agent onboarding process.

The carrier’s existing workflow relied on email-based submissions, manual NIPR license checks, and spreadsheet-driven hierarchy-tracking. With disconnected Anti-Money Laundering (AML) and background verification processes, the carrier faced significant operational hurdles.

What's in this article:

- Why manual agent onboarding is risky for carriers

- How our automation platform reduced onboarding cycles from weeks to days and workload by 65%.

- How a configurable rules engine eliminates regulatory blind spots

- How the cloud-native framework handles high-volume recruitment spikes without lag

Appointment times frequently stretched between two and four weeks, while inconsistent document formats led to a prolonged cycle of errors and manual resubmissions. This fragmentation, compounded by missing documentation and a lack of centralized audit trails, created substantial regulatory exposure.

To sustain their growth trajectory, the carrier needed a centralized, secure, and scalable onboarding automation platform. We began with a deep dive into the distribution lifecycle.

What Our Analysis Revealed

Our analysis covered the entire journey, from the moment an agent submits their details to the final "Ready-to-Sell" status. Our team evaluated every touchpoint, including multi-state compliance mandates, carrier-specific suitability checks, and the critical integration points where the carrier connects with distribution partners.

We found that approximately 70% of the workflow consisted of predictable, rules-based tasks, such as verifying licenses or checking Anti-Money Laundering (AML) certifications. These manual steps were identified as prime candidates for automation.

Approximately 70% of the workflow consisted of predictable, rules-based tasks, such as verifying licenses or checking Anti-Money Laundering (AML) certifications.

Our assessment also identified risk points in the distribution chain. For example, allowing an agent to solicit business before official appointment approval can lead to severe penalties. We focused on building a system that could enforce "Not Authorized to Solicit" flags until every compliance checkbox was verified.

What We Built

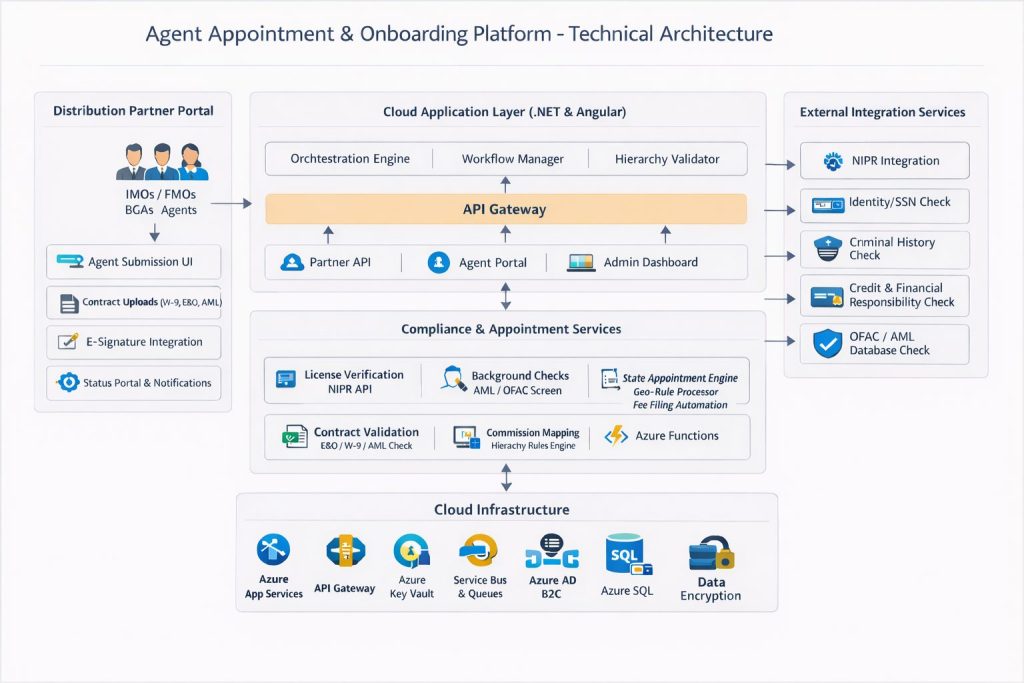

We developed a centralized Agent Appointment and Onboarding Platform designed to act as a single source of truth for the carrier’s entire distribution hierarchy.

The platform integrates the following core components into a synchronized workflow:

Distribution Partner Portal

We replaced disparate email submissions with a standardized digital entry point. Large-scale distribution partners, including Independent Marketing Organizations (IMOs) and Brokerage General Agencies (BGAs), can now upload bulk contracting packets through a single interface. The system performs real-time validation upon upload, ensuring that only complete, error-free applications enter the carrier's processing queue. This drastically reduced the back-and-forth communication that previously delayed agent activation.

Automated Validation Engine

The platform integrates directly with the National Insurance Producer Registry (NIPR) to perform real-time license verifications across all 50 states. To further compress the onboarding timeline, we automated several critical compliance checks:

- Identity & SSN Checks: The system performs automated SSN/Identity checks and W-9 verification to ensure accurate tax reporting and identity integrity from the outset.

- Background Screening: Direct integration with third-party vendors enables automated criminal history checks.

- Liability Verification: The engine enforces strict validation of Errors and Omissions (E&O) coverage, ensuring every agent meets required liability limits before progressing.

- Federal and Carrier Training: Integration of Anti-Money Laundering (AML) certificate tracking ensures every agent meets federal and carrier-specific training requirements before they are authorized to sell.

Hierarchy Management

One of the most complex manual tasks was tracking agent relationships. We built a Validation Engine for upline/downline structures that ensures every agent is correctly placed within the distribution tree.

- Auto-Assignment: The system automatically assigns commission schedules based on the validated hierarchy.

- Conflict Detection: It identifies overlapping hierarchies in real-time, preventing compensation errors.

- Auditability: Every change is logged, creating an audit-ready compensation trail.

Appointment Status Dashboard

To replace error-prone manual tracking, we implemented a real-time dashboard that provides:

- Pipeline Visibility: A bird’s-eye view of where every agent stands in the onboarding funnel.

- SLA Monitoring: Automated tracking to identify exactly where bottlenecks occur.

- State-Level Tracking: Granular views of appointment status across different jurisdictions.

Other Challenges Addressed

The solution also accounts for complexities such as variance in state-level regulations and inconsistent formats, which tend to stall the appointment lifecycle.

Solving Regulatory Complexity

Insurance appointment rules can change frequently depending on the jurisdiction. To solve this without requiring constant software updates, we implemented a Configurable State Rules Engine. This allows the carrier’s compliance team to update filing rules and timelines through a simple user interface, ensuring the system stays current with changing laws without technical intervention.

Standardizing Inbound Data

To address the issue of inconsistent data formats from IMOs and BGAs, we utilized Optical Character Recognition (OCR) to automatically read and validate uploaded documents. By enforcing mandatory digital templates, we established a level of data hygiene.

Solution Architecture

Recruitment in the insurance industry is often cyclical, with significant spikes during product launches or year-end drives. To handle these surges without performance degradation, we built the platform on an event-driven architecture using Microsoft Azure. By utilizing a message-based processing system, the platform can handle thousands of simultaneous background checks and filings in the background, ensuring that Service Level Agreements (SLAs) are met even during peak volume periods.

Core Tech Stack

- Frontend: Angular was used to build the Partner Portal, ensuring that IMOs and BGAs have a high-performance interface for bulk uploads and real-time status tracking.

- Backend: .NET Core APIs provide a robust, secure service layer, handling complex business logic and third-party integrations with high throughput.

- Cloud Orchestration: Hosted on Microsoft Azure, the platform utilizes a Service Bus architecture for queue-based processing. This prevents system bottlenecks during peak onboarding seasons.

- Data Management: SQL Server serves as the central repository, ensuring ACID compliance for sensitive agent data, hierarchy mappings, and audit logs.

Note: While this specific stack was optimized for the carrier’s environment, the underlying architectural principles are technology-agnostic. The solution is designed to be adaptable, whether a firm’s ecosystem is built on Java, Python, or alternative cloud providers like AWS or GCP.

Key Integrations

The platform acts as a central hub, orchestrating data between multiple external and internal endpoints:

- NIPR Integration: Real-time pulls for multi-state licensing and appointment data.

- Risk & Compliance APIs: Automated hooks for AML verification, OFAC screening, and background check providers.

- E-Signature & Document Management: Seamless integration with digital signature platforms to finalize contracting packets without manual intervention.

What Changed for the Carrier

The transition from a manual to an automated environment transformed the carrier's operational capacity and strengthened their partner relationships.

- Accelerated Speed-to-Market: Standard appointment turnaround dropped from nearly a month to 3–5 business days. This allows agents to begin writing policies and generating revenue weeks earlier than before.

- Operational Efficiency: Manual review workloads were reduced by 65%. This shift allowed the carrier's internal staff to focus on complex compliance escalations rather than routine data entry.

- Mitigated Compliance Risk: Automated screening and "just-in-time" appointment logic ensured that no agent could solicit business until every regulatory requirement was met, protecting the carrier from potential fines.

- Strategic Transparency: Leadership now has access to real-time dashboards showing the agent pipeline, state-level approval times, and the performance of various distribution partners.

By treating agent onboarding as a strategic growth lever, the carrier has built a scalable infrastructure that supports both its aggressive expansion goals and its long-term compliance requirements.