Stablecoins are emerging as a powerful new piece of financial infrastructure at the intersection of speed, cost-efficiency, and security. They strip away the volatility of cryptocurrencies while retaining the efficiency of blockchain technology, offering a robust solution for retailers seeking to streamline payments, modernize B2B flows, and create more valuable loyalty programs.

What's in this article:

- Why legacy payment systems are eroding retail margins

- How stablecoins work and change payment economics

- Where retailers can apply stablecoins for real impact

The market consensus reinforces this shift. Analysts predict mainstream adoption within two years, and evolving regulation, such as the U.S. GENIUS Act, adds necessary clarity, making this an ideal time for strategic engagement.

The need for this modernization is rooted in the immense financial burden of legacy payment rails. Take the case of Walmart: In fiscal year 2024, the company reported $648 billion in revenue and $15.5 billion in profit. Nearly $10 billion of that was absorbed by card processing fees alone. Cutting these fees, even by a small percentage, translates directly into a significant boost in margin and bottom-line profit.

The Margin Multiplier: Stablecoin's True Value

Stablecoins function as a margin multiplier by attacking the three biggest friction points in retail transactions: fees, time, and fraud.

- Dramatically Lower Fees: Stablecoin payments typically cost around 1–2%, compared to the 2–3.5% charged by most credit card networks.

- Instant Settlement: Transactions settle in seconds or minutes, 24/7. This substantially improves retailer cash flow and working capital efficiency, a stark contrast to multi-day bank settlements.

- Inherent Security: Payments typically cost around 1–2%, compared to the 2–3.5% charged by most credit card networks.

For retailers operating at scale, these efficiencies transform stablecoins from a speculative instrument into a strategic financial tool for protecting margins.

How Do Stablecoin Payments Work?

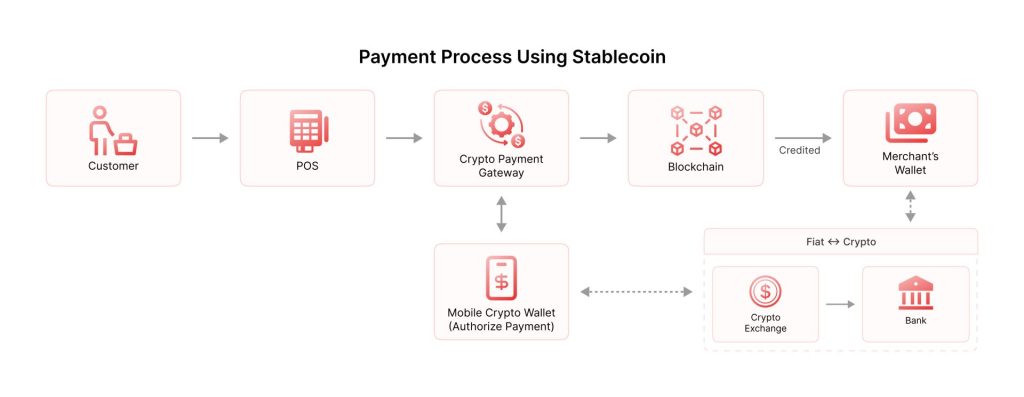

The transaction originates at a digital-asset-enabled POS. Unlike legacy hardware that requires dial-out to a card network, this system interfaces with a crypto payment gateway, allowing for a seamless user experience that mirrors a standard card tap.

Data is routed to a crypto payment gateway. This middleware acts as the translation layer, instantly calculating the exchange rate and converting the fiat purchase amount into the precise stablecoin equivalent. This locks the value, insulating the merchant from intraday fluctuation.

The customer authenticates the transfer via their digital wallet. Instead of a magnetic swipe or chip read, the wallet provides a cryptographic signature. This "push payment" model eliminates the need for the merchant to pull sensitive data, drastically reducing PCI compliance scope.

The transaction is broadcast to the blockchain ledger. Validation occurs in seconds. Crucially, this bypasses the traditional "four-party model" (issuing bank, acquiring bank, card brand, processor), removing the intermediaries that typically slow down settlement.

Upon settlement, the merchant exercises full optionality. Funds can be held as stablecoins to facilitate B2B disbursements and yield generation, or automatically converted to local currency and transferred into operating accounts.

Unlocking Strategic Enterprise Value

Beyond simple cost-cutting, stablecoins offer large enterprises a way to fundamentally re-architect their financial infrastructure:

- B2B Supply Chain Automation: By replacing manual invoicing with programmable smart contracts, businesses can automate vendor settlements the moment delivery conditions are met. This innovation can cut working capital cycles and eliminate the administrative costs and delays common in traditional B2B payment systems.

- Loyalty and Engagement Innovation: Unlike traditional, siloed points systems, stablecoins are liquid and transferable. They can power next-generation loyalty programs that are more valuable and "sticky" for the customer, and act as a significant differentiator for the retailer.

- Closed-Loop Ecosystems: For large enterprises, the ultimate play is to issue their own branded stablecoin. This "walled garden" can maximize transaction savings, deepen consumer data insights, and establish a direct financial channel to the customer.

The market is already primed for this shift. With mobile payments now driving 23% of all transactions and nearly half of remote purchases, the consumer demand for digital-first experiences is proven. The current challenge is not so much in driving consumer adoption but in businesses moving past the legacy systems that still incur high costs.

While hurdles like regulatory compliance (KYC/AML), system integration, and complex treasury management remain, these are the typical frictions that all major payment innovations, from credit cards to e-commerce, have overcome. Retailers that act now, starting with low-friction, high-value use cases like B2B payments and loyalty programs, will be first to reap the full benefits of this margin multiplier.